市场

| 合约 | 最新价格 | 24 小时变化 | 24 小时交易量 | 行动 |

|---|---|---|---|---|

P-BTC-80000 31 Jan | 15 | -94.76% | $2.24M | 立即交易 |

C-BTC-85000 31 Jan | 107 | -45.13% | $1.52M | 立即交易 |

C-BTC-89200 31 Jan | 15 | 0% | $1.51M | 立即交易 |

P-BTC-84200 31 Jan | 364.1 | -6.88% | $506.57K | 立即交易 |

C-BTC-84400 31 Jan | 249 | -53.97% | $421.76K | 立即交易 |

C-BTC-84800 31 Jan | 119 | -69.87% | $421.37K | 立即交易 |

P-BTC-80400 31 Jan | 260 | -3.35% | $399.82K | 立即交易 |

C-BTC-84600 31 Jan | 290 | 42.16% | $337.44K | 立即交易 |

查看所有的市场

交易期权的最佳功能

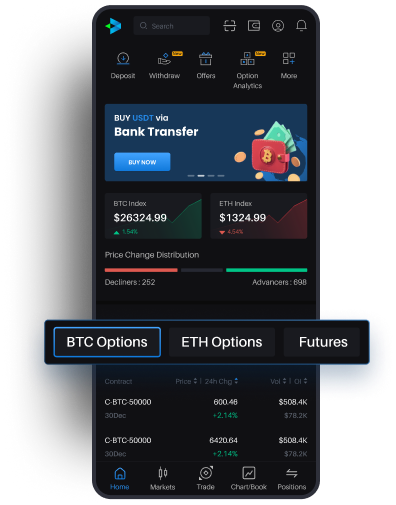

Buy Crypto and Trade

Buy crypto directly using credit / debit cards and start tradingVersatile Margining

Trade with margin modes of your choice: Isolated, Portfolio and Cross MarginWithdraw to Crypto Wallet

Withdraw crypto directly into your crypto wallet策略生成器

创建并分析您的交易与策略一篮子订单

用一篮子订单同时下达多个订单损益分析

使用一流的损益分析功能轻松分析您的每日收益与损失深度价外/价内期权

交易每日和每周到期的深度价外/价内期权为什么选择达美交易所?

达美交易所是交易加密货币衍生品产品的最佳场所。

![[object Object]](/images/homepage/chooseDelta/bestLiquidity.png)

最佳流动性

我们的期权簿拥有业内最窄的利差。 对比特币和以太币而言,利差少于 2 BPS。我们提供高达 100 倍的杠杆,所有合约均以泰达币、比特币或以太币结算。![[object Object]](/images/homepage/chooseDelta/lowestFees.png)

最低费用

我们的期权费在市场上是最低的。要么是 3.75bps,要么是 7.5% 的期权溢价,以较低金额为准。![[object Object]](/images/homepage/chooseDelta/lock-key.png)

安全可靠

用于保护数字资产的企业级多要素安全措施 。所有提款均经过人工审核处理。![[object Object]](/images/homepage/chooseDelta/robotFace.png)

24/7 支持

90% 的支持查询可在 24 小时内得到解决还没有帐户! 30 秒内注册,便可开始您的期权之旅。

得到最佳加密货币投资者的支持

新闻中的达美

学习就是赚取财富

阅读我们的博客,了解杠杆交易、加密衍生品和交易策略

立即加入我们的社区

有问题吗?与我们的社区互动

什么是加密货币期权?

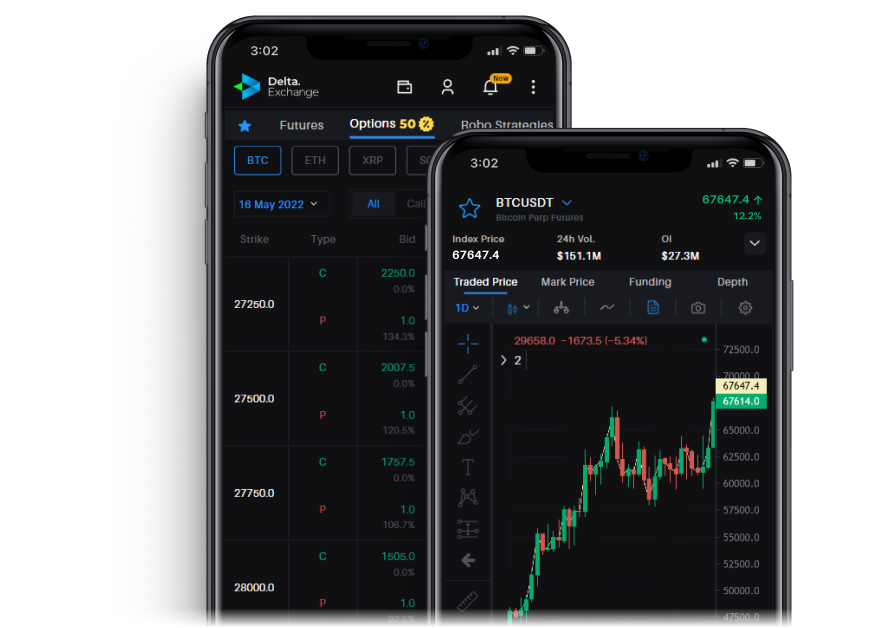

Crypto options contracts are derivative instruments that let you speculate on the future performance of cryptocurrencies like Bitcoin. Delta Exchange offers an Options Chain for comparing and trading in options on BTC and ETH. With our platform, you can avail a wide array of options for trading, including call options and put options.

Delta Exchange brings you options on BTC and ETH- the kings of the crypto world. You can trade call and put options with daily, weekly, monthly and quarterly expiries on Delta Exchange for the lowest settlement fees and fastest withdrawals! Moreover, you have MOVE options as well on the same two cryptos at your disposal!

如何交易加密货币期权?

加密货币期权合约是一种衍生工具,买方或持有者没有义务执行交易。因此,加密货币期权交易者有权以固定价格买入或卖出具有到期日的加密货币资产,但他们没有义务这样做。

要想在比特币期权等工具上进行简单的期权交易,达美交易所是您的理想选择。在达美交易所,您可以将保证金交易与诱人的杠杆率相结合,以获得绝佳的加密货币期权交易体验。我们提供比特币、以太币、索拉纳币、币安币以及 {{numOfCoins}} 多种山寨币的期权。

我可以在达美交易所交易比特币期权吗?

A MOVE contract is what is called a crypto option straddle or an option that is direction neutral- so you have the choice to combine call and put options with the same strike price. MOVE contracts on Delta Exchange let you trade in BTC and ETH options at daily expiries and even weekly expiries, that too at the lowest settlement prices!

为什么要进行加密货币期权交易?

Crypto options are derivatives instruments. Buyer of an option is required to pay the premium upfront to have the right but not the obligation to buy/ sell the underlying crypto at settlement. On the other hand, option sellers receive the premium paid by the buyer and are also required to post a margin. All you need to do to start trading crypto options is simple - sign up to Delta exchange (it’s free!), select the option you want to trade in, choose the order type, and voila - you’ve just placed your first crypto options trade!

With Delta Exchange, you can easily trade options on various cryptocurrencies, including Bitcoin options. Take advantage of our user-friendly interface and powerful trading tools to make informed decisions. We offer Options Chains for trading in crypto options on BTC and ETH . With us, you can trade crypto options with the lowest settlement fees and fastest withdrawals!

为什么要选择达美交易所进行加密货币期权交易?

The short answer is yes! Delta Exchange, the premier options trading platform, is your gateway to trade Bitcoin call and Put options. With daily expiries, low settlement fees, quick withdrawals, high liquidity, and tight spreads denominated in the USD, Delta Exchange provides an unmatched trading experience.

Join our community of traders who trust us for our robust options trading platform and reliable liquidity trading on BTC and ETH options. Sign up today to start trading Bitcoin options on Delta Exchange!

Why Trade Crypto Options?

There are several compelling reasons why trading crypto options can be advantageous:

- Hedging and Speculation : Crypto options allow you to hedge your positions or speculate on the future prices of underlying assets.

- Capital Efficient Trading : Traders can leverage the portfolio margin mode to create capital efficient trading strategies that can help to boost return on trading capital

- Choice of Call and Put Options : Depending on your market outlook, you can choose between call options or put options to align with your specific trading preferences. Further, you have the option to choose MOVE contracts as well!

- Daily Expiries and Lowest Settlement Fees : Delta Exchange offers daily expiries, allowing you to take advantage of short-term opportunities. Additionally, enjoy the benefit of lowest settlement fees in the market.

- Fastest Withdrawals and High Liquidity : Delta Exchange ensures speedy withdrawals and provides high liquidity for seamless trading experiences.

- Choice of Cryptocurrencies : Trade call and put options, as well as MOVE contracts on BTC and ETH, providing you with diverse trading opportunities.

Why Choose Delta Exchange for Trading in Options?

Delta Exchange is your premier destination for trading in options on cryptocurrencies. Our platform offers an exceptional Options Chain that caters to your trading needs. Whether you are trading BTC or ETH, Delta Exchange provides

- the lowest settlement fees,

- fastest withdrawals,

- and high liquidity.

We take pride in our customer-centric approach and offer attractive features like the Options Chain, competitive deposit bonuses, trading-linked Delta Cash rewards, and round-the-clock customer support. Choose Delta Exchange for a seamless experience in trading in crypto options.

Join our trusted platform today and experience the power of trading in options with Delta Exchange.

什么是衍生品?

衍生品是一类金融合约,其价值源自标的实体的业绩。标的物为加密货币或加密资产的衍生品,如比特币、以太币等,被称为加密货币衍生品。加密衍生品的交易并不涉及实际买卖比特币或其他加密货币。加密衍生合约的价值随着标的加密货币价格的变化而变化。因此,以另一种方式交易加密衍生品,以获得对标的加密货币或加密货币的风险敞口。

加密货币衍生品的种类

加密货币衍生品合约的主要类型包括期货、期权、差价合约(CFD)、永续合约和掉期交易。加密货币衍生品合约在交易所场内和场外(OTC)都有交易。交易所交易的衍生品是标准化合约,通常流动性很强。相比之下,场外衍生品交易是双方之间的定制合约。

加密货币衍生品的用途

加密衍生品用例主要分为三类。它们是: (a) 对冲:本质上是对您已经拥有的加密资产的不利价格变动的保险。例如,矿工可能想锁定开采的比特币的价格而不出售,(b)投机:交易者根据自己的市场观点,利用加密货币衍生品创建杠杆收益的配置文件,以及(c)访问:不能直接购买比特币或加密货币的交易者,有可能通过加密货币交易平台或加密货币衍生品交易所的衍生品获得对它们的敞口。

好处

对于交易者和投资者来说,加密衍生品提供了在现货加密交易中无法获得的几个好处。这包括:(a) 做多和做空的能力,即从市场上涨和下跌中获利,(b) 杠杆交易,使交易者能够持有更大的头寸,(c) 强大的流动性,减少加密货币交易费用。